Our Life is full of shocks and surprises, we experience twists and turns in life. From job loss to unexpected expenses, life certainly pushes us into financial crises. In times of financial crises having a safety wall makes all the difference. Here is where the concept of an Emergency fund comes into play. It is designed to protect our investment and long-term financial goals.

Understanding the Emergency Fund

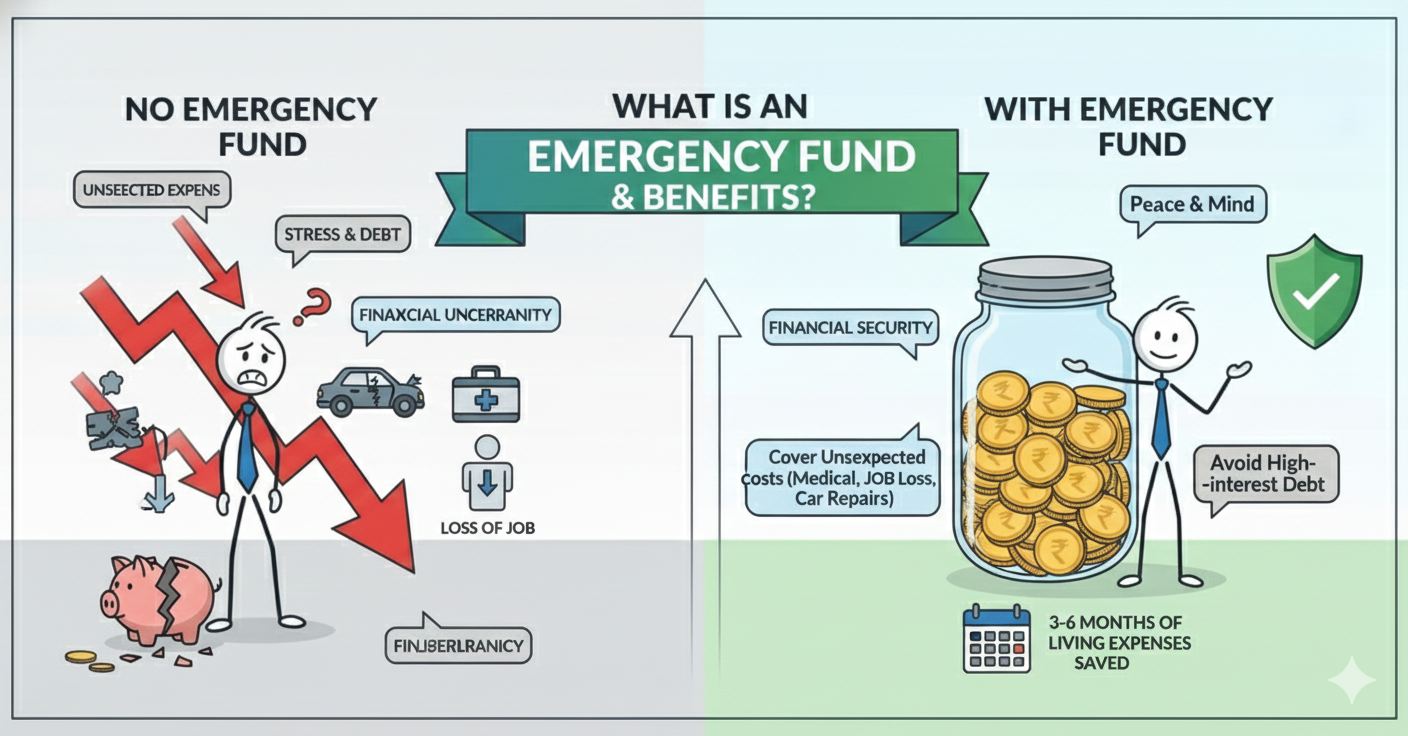

An emergency fund is essentially a pool of money set aside specifically to protect from unexpected expenses and financial crises. It works as a protection wall, providing peace of mind and stability during tough times. An emergency fund is a priority of your financial planning. It is not like your other planned expenses like vacations, new car or home renovations. It must be taking care of your sudden job loss, medical emergency or any other essential work.

Let’s understand the importance of emergency funds. The recent COVID-19 pandemic highlighted the crucial role of emergency funds. People were forced to stay at home without pay. Many people lost their jobs. Corona makes us move to think about saving and investing. The world was unsure of when this pandemic would end. People used credit cards and broke their investments to manage their basic living expenses. People were trapped in credit card debt or lost their savings and investments because they did not have protection provisions or funds for such situations. Emergency funds will give you a stress-free life, protect your investment and give you time to recover from situations.

The Importance of an Emergency Fund:

- Financial Security: During financial crises, emergency funds work as a protection wall. It ensures that you can manage your living expenses without taking high-interest loans or tapping into long-term investments.

- Reduce Stress: Financial worries can affect your mental and physical health. Knowing that you have a financial cushion in place can give you relief from stress and anxiety. You can focus on finding solutions during your tough times.

- Prevents Debt Accumulation: Without an emergency fund, unexpected expenses often end up on credit cards or personal loans, leading to debt accumulation. Having cash reserves can prevent this cycle and save you from falling into a debt trap.

- Flexibility and Independence: An emergency fund provides financial flexibility, allowing you to make decisions based on your needs rather than being forced into choices due to financial constraints. It grants you the freedom to navigate through life’s uncertainties with confidence.

How Much Should You Save?

This is an important and tough question. So before deciding how much to save, we need to decide how much we need. The size of your emergency fund depends on various things such as your monthly expenses, income stability, and individual circumstances. The basic rule says you must have at least 6 months’ worth of living expenses. Here are some steps which will help us to determine how much we need and how we will achieve it.

- Set Clear Goals: Define your financial goals and assess your current financial situation. Goals will help you to remain on track to achieve your goals. Without goals like running without knowing the finish line. It motivates you and helps you to make decisions.

- Create a budget: Budgeting is an important task of the financial journey. It will give you a clear picture of your finances like how much are you earning and how much are you spending? What type of expenses do you have?

- Increase contributions over the period: As your earnings and financial situation improve, start increasing contributions towards your emergency fund and other goals.

- Discipline and Planning: Set up an auto transfer to your fund. It will ensure consistent contributions. First, achieve 6 months’ worth of expenses, and later increase it to 1 year. Once you reach the 1-year goal, aim to increase the fund size. Now you can reduce your contribution and divert the access amount to other financial goals.

Where to Keep Your Emergency Fund

Emergency fund’s first condition is it must be easily accessible. An emergency will never strike you by deciding the day and time. Your traditional savings account offers easy access to your money. Such accounts will not appreciate much of your money so you can keep 20% of your fund in it. You can explore high-yield interest accounts, FDs and the money market which gives you high returns and liquidity.

Conclusion

It is a journey of financial stability and emergency funds will play a major role in it. It will protect your savings and peace of mind during tough financial times. Start building an emergency fund today and proactively prepare your life for life’s uncertainty. Empower yourself to face whatever the future is, knowing that you have a strong financial foundation.