Imagine this; you’ve spent decades working, running behind deadlines, juggling responsibilities, and putting your dreams on hold. Retirement finally arrives, a time you once imagined as peaceful, joyful, and full of freedom. You picture yourself travelling, learning new skills, or simply enjoying quiet mornings without rushing for work.

But then reality hits. The salary that has supported your lifestyle for years suddenly stops. And without proper planning, what should have been the best phase of your life can quickly turn stressful. No one wants to spend their old age worrying about bills or being forced to work just to survive.

That’s why planning early is not just important — it’s essential. Time is your biggest friend on this journey. The earlier you start, the stronger your foundation becomes. We’ve already covered Plan 1: Building your emergency fund. Now, it’s time for Plan 2: Preparing for your retirement life. And this is where the National Pension System (NPS) becomes your partner in creating a secure and peaceful future.

What is the National Pension System ( NPS )?

These days, many government / non-governments backed pension and retirement plans are available in the market. But this article will go through one of the most popular government-backed initiatives, “National Pension Systems”.

On December 22, 2003, the Government took an important step toward securing the future of its people by launching the Contributory Pension System, later known as the National Pension System (NPS). At first, it served only Government employees. But with time, a deeper truth becomes clear; retirement is not just a phase; it is a reality for everyone. Whether a worker, a businessman, a farmer, or a homemaker, every citizen deserves dignity, security, and peace in old age. Understanding this, the Government opened NPS to all citizens of Bharat, giving every individual the power to build a safe and respectful life after retirement.

NPS is government-sponsored, regulated by the Pension Fund Regulatory and Development Authority (PFRDA). To make it affordable, the government kept the fund management charges cheap; it makes NPS one of the cheapest actively managed funds. So, let’s understand the details about NPS.

How many types of accounts?

The NPS scheme has two account types. Tier I and Tier II accounts. Its working and purpose is different as follows.

Tier I Account:

This is the primary and mandatory retirement account for subscribers. Its main goal is to help you build a substantial retirement corpus. Regular, disciplined contributions are essential for maximizing appreciation and building a strong corpus.

The Government ensures this scheme is accessible to the low-income working / non-working class by keeping contributions affordable. An account can be opened with an initial deposit of just ₹500. Participants must maintain an annual deposit of at least ₹1,000 to prevent the account from being frozen. While the minimum transaction amount is ₹500, there is no limit to the number of transactions you can make. Subscribers can withdraw a certain amount with conditions.

Any individual between the age group of 18 to 70, whether he/she is an employee of the private sector or government, a small businessman, farmer, housewife or anyone can open an account in NPS. Non-resident or Overseas Citizens of India can also open an account.

Tier II Account (NPS)

The Tier II account is a voluntary account that is linked to your Tier I account. You must have an active Tier I account before opening a Tier II account. The minimum amount required to open this account is ₹1,000, and the minimum contribution per transaction is ₹250.

Unlike the Tier I account, there are no restrictions on withdrawals from a Tier II account. You can withdraw any amount at any time and transfer funds from Tier II to your Tier I account. In this way, the Tier II account functions like a regular savings or investment account, offering flexibility and easy access to your money.

Withdrawal Rules – Tier I Account (NPS):

The Tier I account is a retirement-focused pension account designed to help you build a secure financial future. Since the main goal is long-term wealth creation for retirement, the Government has put certain withdrawal restrictions in place to protect your savings from being used too early.

Normally, the funds in a Tier I account remain locked until the subscriber reaches the age of 60 years (retirement age).

Partial Withdrawal Facility (Before Retirement)

Understanding that life can bring unexpected needs, the Government allows limited early withdrawals under specific conditions.

- Partial withdrawals are allowed after 3 years from the account opening date.

- You can withdraw up to 25% of your own contributions.

- A maximum of 3 withdrawals are allowed during the entire investment period.

Partial withdrawals are permitted for important life needs such as:

- Higher education of children.

- Marriage of children.

- Purchase or construction of a house.

- Treatment of critical illnesses.

Partial withdrawals allowed in certain life events are tax-free (Subject to submission of valid documents).

Premature Withdrawal (Before 60 Years)

Sometimes subscribers decide to premature exit; they may need their funds before retirement. Still to secure the retirement fund, the government allows under specific conditions only.

- 80% of the corpus must be used for the annuity plan ( Pension ). That will secure a retirement fund.

- 20% of the corpus can withdraw. But if the total corpus is less than or equal to 2.5 lakh, the subscriber can withdraw the entire amount from the account.

- Premature withdrawal allowed only those subscribers who maintained their account for at least 10 years.

Withdrawal at Retirement (60 Years)

On retirement, subscribers can withdraw their amount from the Tire I account as follows.

- If the total corpus is ₹5 lakh or less, you can withdraw the entire amount without purchasing an annuity (Pension).

- You will withdraw 60% of your corpus as a lump sum, and it is completely Tax-Free.

- The remaining 40% of the corpus will be used to purchase an annuity (Pension). The amount received from an annuity plan (Monthly pension) will be treated as taxable income.

Non-Retirement Withdrawal (Exit before 60 Years)

Life is unpredictable, and sometimes unexpected situations occur. If a subscriber passes away, becomes permanently disabled, or suffers from a serious illness before the age of 60, NPS allows an early exit from the account.

In such cases, the full amount saved in the NPS account can be withdrawn by the subscriber or the nominee. Tax rules may apply depending on the reason for withdrawal.

This rule helps people get financial support when they need it the most.

Annuity Purchases:

Annuity purchase is mandatory (with condition) in the National Pension System. 40% or 20% of the corpus will be used to buy a financial product called an annuity plan. An annuity plan is like an insurance product. It ensures you receive some amount throughout your retirement years. Conversely, you will have limited access to your principal amount. Overall, annuity purchases in NPS ensure guaranteed income for your post-retirement life. You enjoy peace of mind, knowing you have a reliable income source of money to take care of expenses.

Tax Benefits (Tier I):

The purpose of NPS is financial security for life after retirement. It is a necessity of every citizen, so to bring more people on board, the government offers TAX benefits and motivates them to contribute towards their own retirement life. NPS save TAX money that subscribers can use for different purposes.

Tax Benefits on Contributions (Tier I Account)

| Section | For Whom | Max Deduction | Tax Regime |

|---|---|---|---|

| 80CCD(1) | Employee’s/Self-Employed’s Own Contribution. Salaried: 10% of Salary (Basic + DA) Self-Employed: 20% of Gross Total Income | Up to ₹1.5 lakh (Overall limit combined with Sections 80C & 80CCC) | Old Regime Only |

| 80CCD(1B) | Additional Self-Contribution | Up to ₹50,000 (Over and above the ₹1.5 lakh limit of Section 80CCE) | Old Regime Only |

| 80CCD(2) | Employer’s Contribution (Salaried Only) | Up to 10% of Salary (Basic + DA) for Non-Government employees. Up to 14% for Central/State Government employees. | Available in both Old & New Regime |

Subscribers can potentially claim deduction up to 2,00,000 ₹ on their own Contribution ( ₹1.5 Lakh under 80CCD(1) + ₹50,000 under 80CCD(1B) ) using the old tax regime, plus the benefit of the employer’s contribution under 80CCD(2).

Tax Benefits on Withdrawals and Maturity

NPS follow Exempt and Exempt models for certain situations that make NPS tax benefits.

- Lump-sum Withdrawal at retirement (Age 60) – Under section Section 10(12A), 60% of the accumulated corpus is tax-exempt. The remaining 40% is mandatorily used to purchase an annuity.

- Annuity Purchase at retirement – Under section 80CCD(5), The amount used to purchase the mandatory annuity (minimum 40% of corpus) is tax-exempt.

- Partial Withdrawal – Under section 10(12B), Up to 25% of your self-contribution is tax-exempt for specific purposes (e.g., child’s education, medical emergency) after a minimum lock-in period.

Note: The pension income received from the annuity is taxable in the year of receipt as per your applicable income tax slab.

Since tax rules can be complex and are subject to change, I highly recommend consulting a financial advisor or tax professional for advice tailored to your specific income and investment scenario.

Where and How does NPS invest our money?

So now the biggest question arrives: where does the National Pension System invest subscribers’ money? The funds must grow while managing risk, as people are investing for their retirement. NPS invests money in four major asset categories, creating a diversified portfolio that helps the money grow with manageable risk.

NPS money managed by professional fund managers.

- Asset Class E: Equity – Higher growth and higher risk.

- Asset Class G: Government instruments – Very safe and lower growth.

- Asset Class C: Corporate instruments – Safer than Equity and stable growth.

- Asset Class A: Alternative investments Funds and instruments like REITS. CMBS etc – Diversifies your portfolio and a little higher risk but limited exposure ( max 5% ) allowed.

To manage funds, subscribers choose Pension Fund Manager ( PFM ) . Please go through the Pension Fund Manager providers.

NPS Pension Fund Managers ( December 2025 ).

- SBI Pension Funds Pvt. Ltd.

- LIC Pension Fund Ltd.

- UTI Retirement Solutions Ltd.

- HDFC Pension Management Co. Ltd.

- ICICI Prudential Pension Fund Management Co. Ltd.

- Kotak Mahindra Pension Fund Ltd.

- Aditya Birla Sun Life Pension Management Ltd.

- Tata Pension Management Pvt. Ltd.

- Axis Pension Fund Management Ltd.

- DSP Pension Fund Managers Pvt. Ltd.

- Max Life Pension Fund Management Ltd. — note: as of 2025, this fund has discontinued operations for NPS.

Flexibility in NPS Management: The National Pension System (NPS) provides flexibility, allowing a subscriber to change their Pension Fund Manager (PFM) if they are unhappy with the investment performance. After selecting a PFM, the next step is to determine the investment approach: Active Choice or Auto Choice. It is important to understand the mechanics of these options to select the one that best suits your convenience and risk tolerance.

Active Option

If subscribers have good financial knowledge and want to manage their investments and risks, then Active option is the most appropriate for such people. In the active option, subscribers can distribute corpus in the 4 assets category according to their choice.

There are some conditions for allocations. The total allocation across E, C, G and A asset classes must be equal( E + C + G + A ) to 100%. ( A is only available in Active Option )

| Asset Class | Maximum allocation of investment in asset class |

|---|---|

| Asset Class E – Equity | 75% |

| Asset Class C – Corporate debt | 100% |

| Asset Class G – Government Bonds | 100% |

| Asset Class A – Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc | 5% |

Auto Options

If you do not have proper investment knowledge about the equity market and its risk then the Auto option is the best choice. The auto option changes your allocation according to age and risk-taking capabilities. It is like the life cycle fund because the invested corpus in assets will change according to the subscriber’s age. All these features make it a pre-defined portfolio, as age increases exposure to equity and corporate debts start to decrease.

NPS also offer 4 options under ‘Auto Choice’ depending on the risk-taking capacities of subscribers.

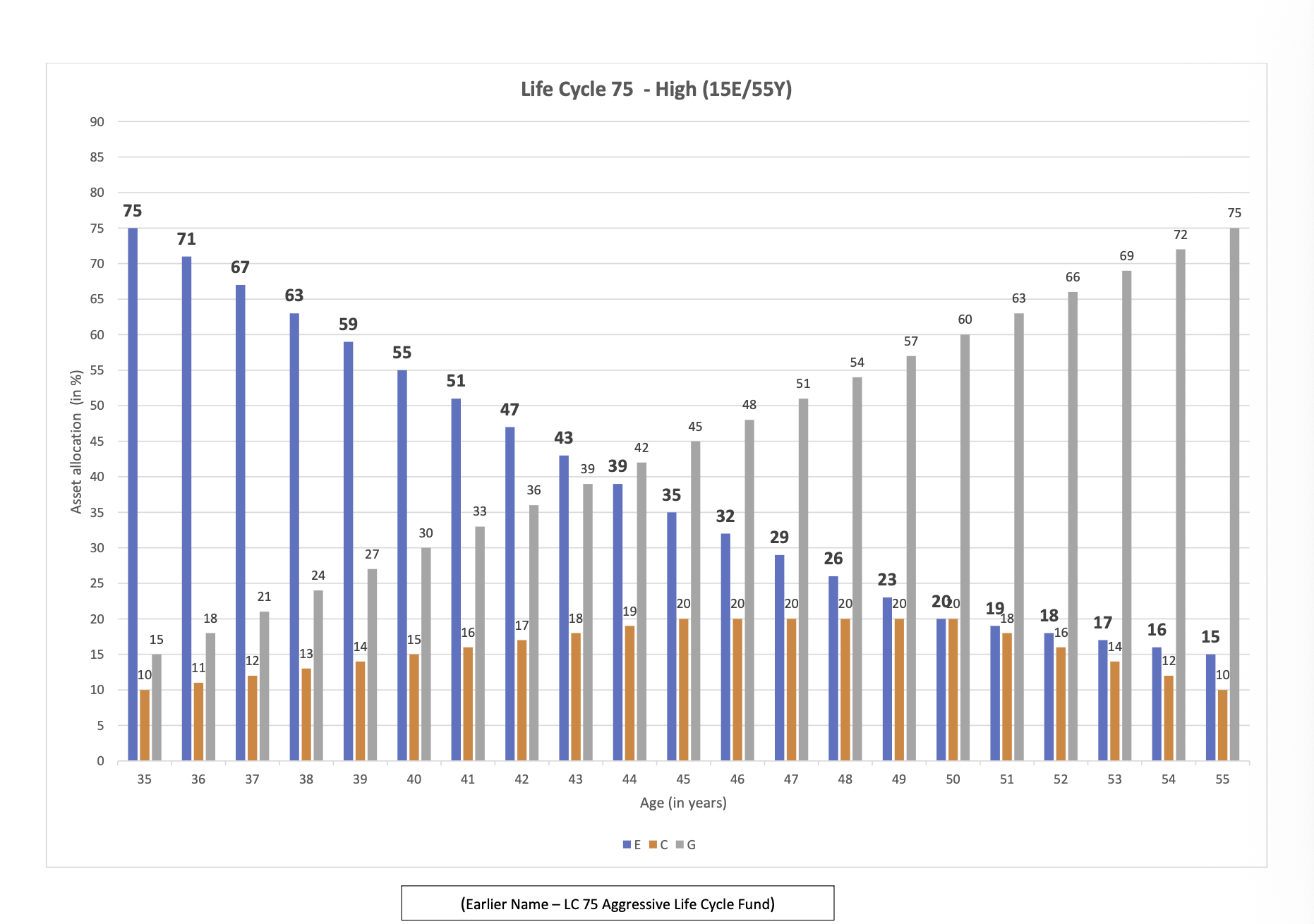

High Life Cycle Fund (LC-75)

If you are someone who wants high growth and can handle some market ups and downs, the High Life Cycle Fund (LC-75) may be right for you.

In this option, up to 75% of your money is invested in equity (share market) when you are young. This gives your savings the best chance to grow faster over the long term.

From the age of 35 years, the system automatically begins to reduce your exposure to equity ( Fall to 15% at the age of 55 ). Your money is gradually shifted into safer investments like government securities and bonds as you grow older. This happens based on a fixed formula, you do not need to do anything manually.

Why does this matter?

When you are young, you can take more risk for better returns. As you move closer to retirement, protecting your savings becomes more important than taking risks. LC-75 takes care of this balance for you.

It is a great choice for people who:

- Are young

- Want higher returns

- Prefer automatic risk control

- Do not want to manage investments regularly

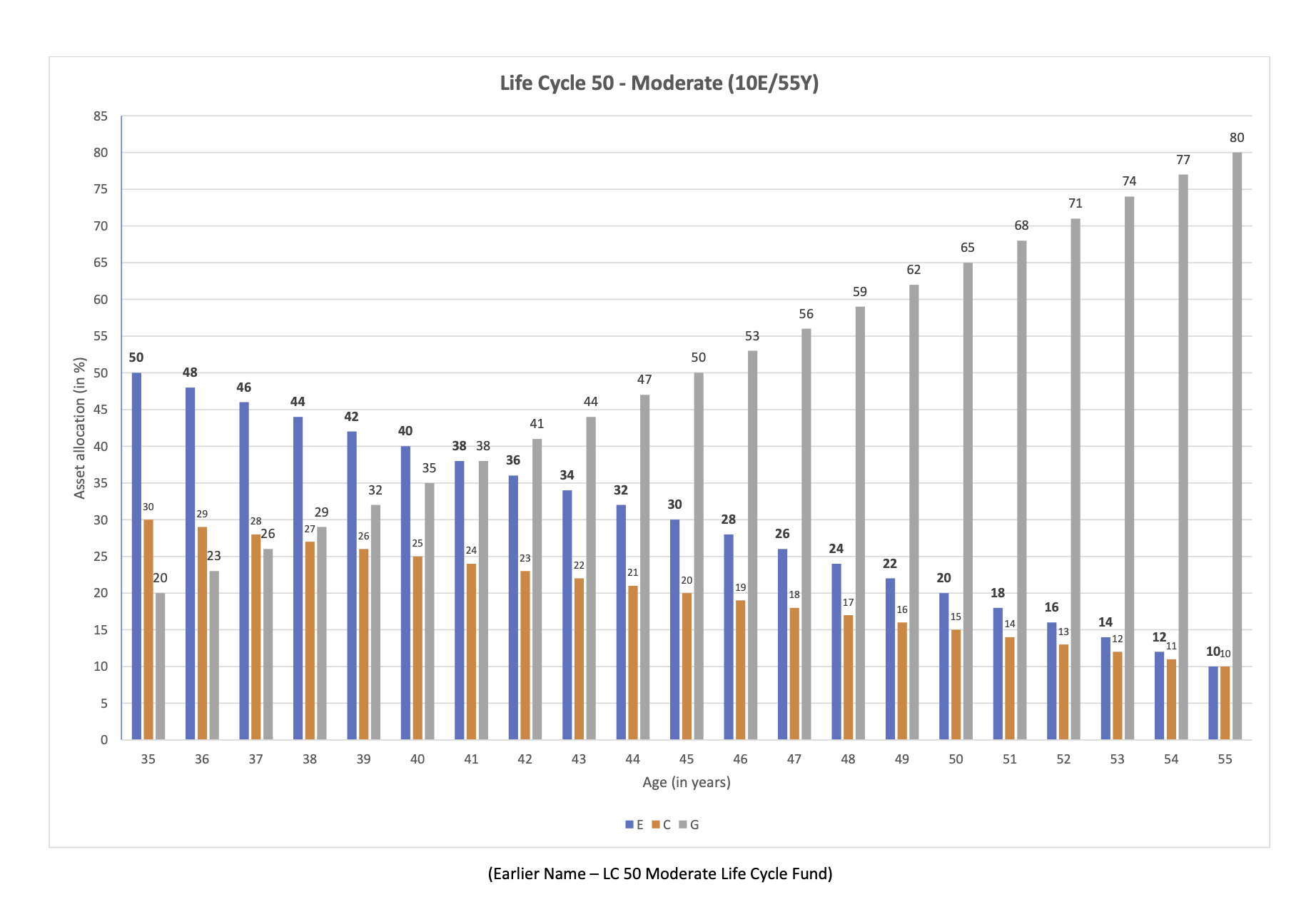

Moderate Life Cycle Fund (LC-50)

If you want a balanced approach between growth and safety, the Moderate Life Cycle Fund (LC-50) can be a good choice.

In this option, up to 50% of your money is invested in equity (share market) when you are young. This helps your savings grow while still keeping risk under control.

Until the age of 35 years, the equity allocation remains at its highest level. After that, it is gradually reduced based on your age ( Fall to 10% at the age of 55 ). Your money is slowly moved to safer investments like government securities and bonds as you grow older, automatically and without any effort from your side.

Why choose LC-50?

LC-50 is ideal for people who want their retirement money to grow, but without taking too much risk. It offers a smart balance:s

- Moderate risk

- Steady growth

- Automatic risk reduction

- Suitable for long-term investors who prefer stability with growth

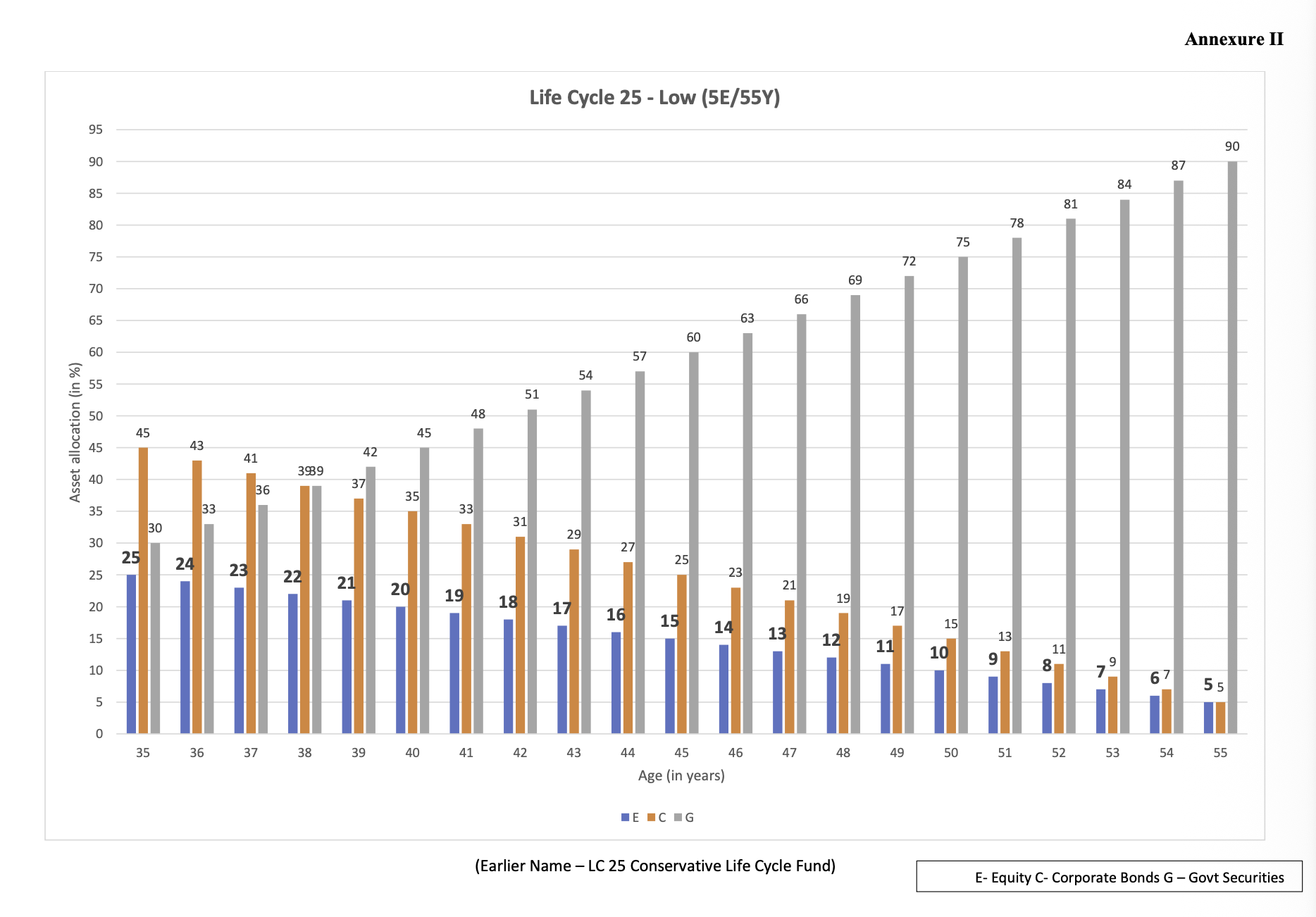

Low Life Cycle Fund (LC-25)

If you prefer safety over high returns, the Low Life Cycle Fund (LC-25) may be the right option for you.

In this plan, a maximum of 25% of your money is invested in equity up to the age of 35. The larger portion of your savings goes into government bonds and corporate bonds, which are considered safer investment options.

As you grow older, your exposure to equity is automatically reduced ( Fall to 5% at the age of 55 ). At the same time, more money is shifted into government securities, which are among the most secure investments available. This protects your savings from market ups and downs as you move closer to retirement.

Why choose LC-25?

LC-25 helps protect your retirement savings while still allowing limited growth through equity investment. It is suitable for people who:

- Want low risk

- Prefer stable returns

- Are close to retirement

- Do not want to worry about market fluctuations

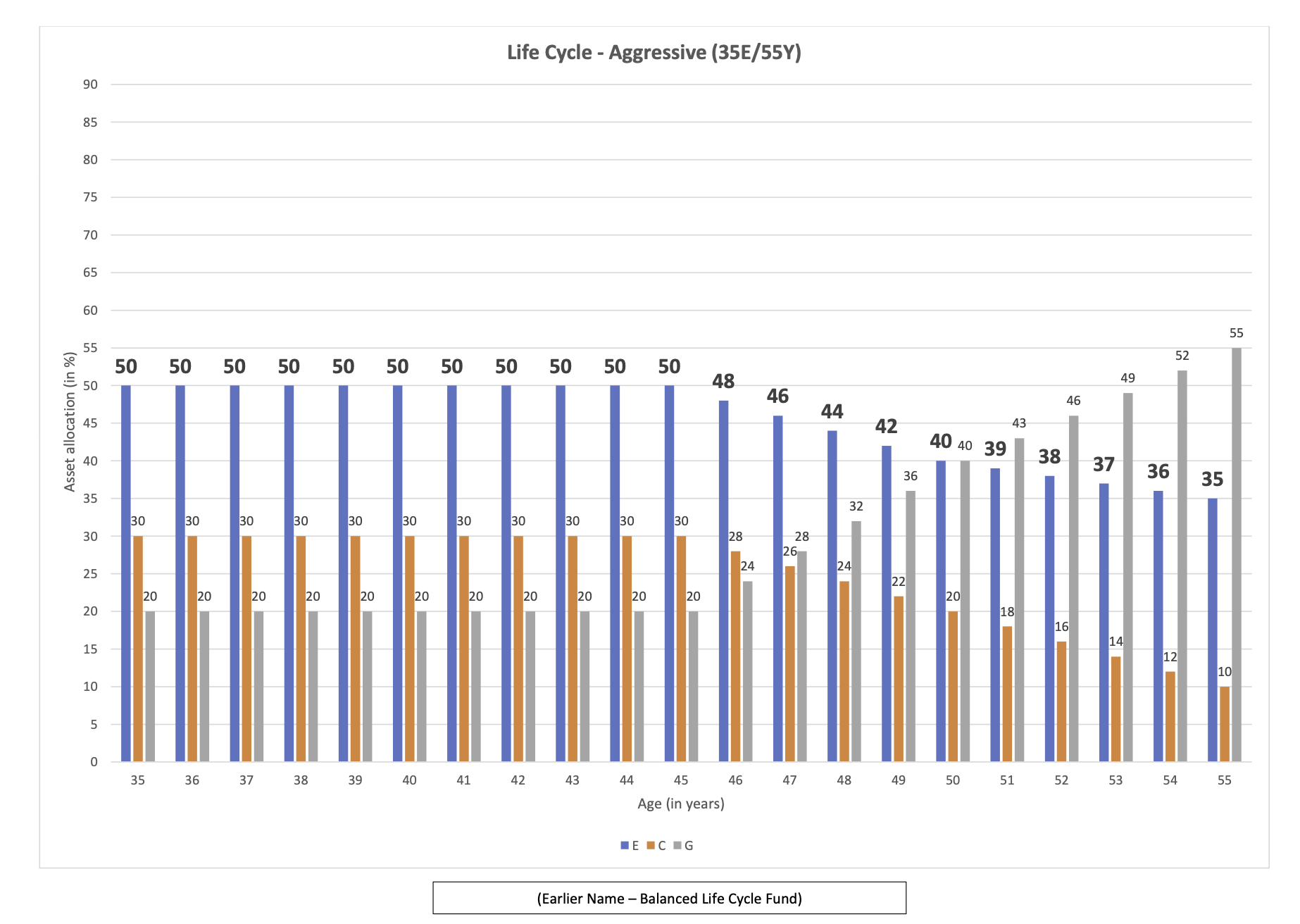

Aggressive Life Cycle Fund (BLF)

If you want a smart mix of growth and safety, then the Aggressive Life Cycle Fund is worth considering.

In this option, your money is evenly spread across equity, government bonds, and corporate debt. When you are young, it keeps a healthy exposure to equity (50% up to age 45 ) for growth. As you grow older, the fund automatically reduces equity and shifts more money into safer assets like government securities and bonds.

You don’t need to worry about market timing or changing investments, the system does it for you.

Why choose the Balanced Life Cycle Fund?

It is ideal for people who want steady growth without taking too much risk, and who prefer a relaxed, hands-free investment approach.

- Balanced risk and return

- Automatic adjustment with age

- Suitable for long-term investors

- No need for active tracking

Role of the Central Record-Keeping Agency (CRA)

All critical information—including your investment allocation, selected PFM, and records of all contributions—is maintained and registered by the Central Record-Keeping Agency (CRA). Essentially, the CRA serves as the central operational hub, acting as the key coordinator and communicator between you, the Subscriber, and the various Pension Fund Managers.

Your NPS money is managed by professional fund managers called Pension Fund Managers (PFMs).

Final Conclusion: Don’t Wait to Start Saving

We have shown that the National Pension System (NPS) is a very good way to save money for when you stop working. It gives tax money back and helps your money grow safely.

But the biggest problem is waiting.

It is a human habit to worry about the money we spend today and think that saving for retirement can wait. We enjoy the money we have now, and the time when we are old seems too far away.

When you wait one year to start saving, you are not just losing the money you could have saved that year. You are losing many years of growth that money could have earned.

The NPS solves this problem.

By opening an account and setting up a small, regular saving amount today, you are making a promise to your future self. The NPS locks this money away for your old age, so you cannot easily spend it now.

Do not sacrifice your comfortable future just to have a little more money today. The best time to start was yesterday. The next best time is right now.

Start your NPS savings today. Your future self will thank you.