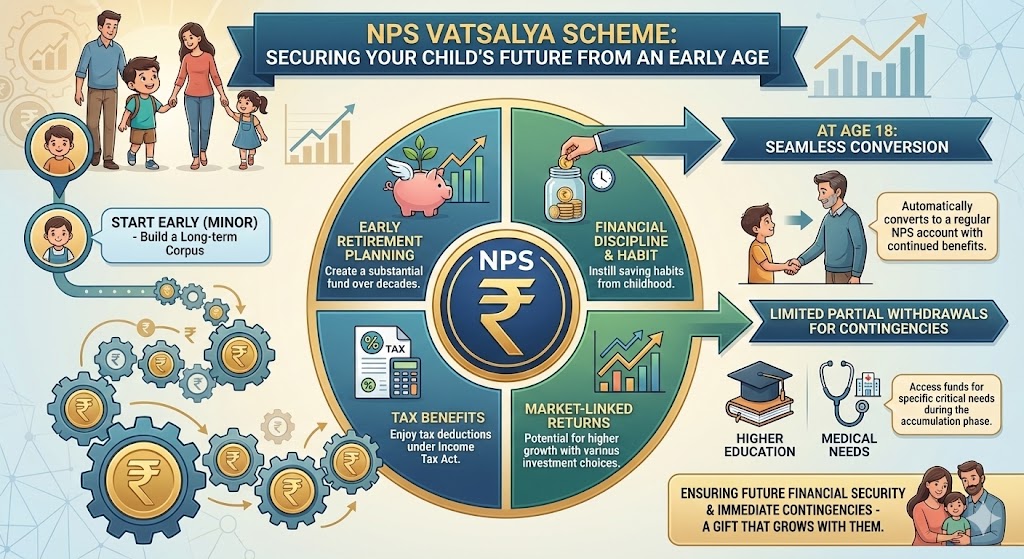

As parents, we dream of giving our children the best start in life. While we focus on their education and immediate needs, have you ever considered securing their long-term financial future, even their retirement, right from childhood?

That’s where NPS Vatsalya (Minors) comes in!

What Exactly is NPS Vatsalya?

Think of it as a special, long-term savings plan under the National Pension System (NPS), but designed exclusively for children under 18. It’s a powerful tool for parents and guardians to start building a significant financial nest egg for their child, harnessing the magic of compounding over decades.

In other way: You’re planting a money tree for your child that will grow into a forest by the time they’re ready for their own retirement.

Who Can Join and How Does It Work?

Let’s understand the key features of this wonderful scheme:

Who is it for? Any Indian citizen who is under 18 years old. Yes, even newborns can have an NPS Vatsalya account!

Who manages it? While the account is in your child’s name, you (the parent or legal guardian) will be the operator until they turn 18.

Their Own Account: Your child gets their very own Permanent Retirement Account Number (PRAN) – a unique ID for their pension journey.

Contributions: You can start with a minimum of just ₹1,000 per year. There’s no upper limit, so you can contribute as much as you wish!

How is the money invested? Just like a regular NPS account, you get choices:

- Active Choice: You decide the exact mix of where the money goes (e.g., how much in stocks, bonds, etc., up to 75% in equity).

- Auto Choice: The system automatically adjusts the investment mix based on your child’s age, making it less risky as they get older. Perfect if you prefer a hands-off approach!

The Power of Compounding: Why Start Early?

This is where NPS Vatsalya truly shines. Imagine investing a small amount consistently for 18 years, and then letting that money continue to grow for another 40-50 years untouched!

Let’s try a quick calculation:

If you invest just ₹2,000 per month (₹24,000 annually) for 18 years, and it grows at an average of 10% per annum:

- Total contributed by age 18: ₹4,32,000

- Estimated corpus by age 18: ~₹10.5 Lakhs

Now, if this corpus continues to grow at 10% per annum until age 60 without any further contributions:

- Estimated corpus by age 60: Over ₹6.5 Crore!

Isn’t that incredible? That’s the magic of starting early with a long-term investment like NPS.

Tax Benefits for You (the Guardian!)

Yes, even if you get a reward for securing your child’s future! Your contributions to the NPS Vatsalya account can fetch your valuable tax deductions:

- Under Section 80C, you can claim up to ₹1.5 lakh (combined with other eligible investments).

- Under Section 80CCD(1B), you can claim an additional deduction of ₹50,000 over and above the 80C limit (if you’re using the Old Tax Regime).

What Happens When They Turn 18?

- It Becomes Their Account: The NPS Vatsalya account automatically converts into a regular ‘All Citizen’ NPS Tier-I account.

- New KYC: Your child, now an adult, will need to complete a fresh Know Your Customer (KYC) process within three months to take full control.

- Withdrawals? Partial withdrawals (up to 25% of your contributions) are allowed after 3 years for specific needs like higher education or critical illness, even before age 18.

- Exiting at 18: If the accumulated amount is ₹2.5 Lakhs or less, they can withdraw the entire sum. If it’s more, at least 80% must be used to buy an annuity (a pension plan) to provide them with a regular income later in life.

Why Consider NPS Vatsalya for Your Child?

- Early Start, Bigger Corpus: The earliest start in investing often leads to the largest wealth creation.

- Financial Discipline: It instills a sense of long-term planning.

- Low Cost: NPS is known for its remarkably low charges, meaning more of your money works for your child.

- Diversified Investments: Professionally managed funds across various asset classes to ensure balanced growth.

- Tax Efficiency: Enjoy tax benefits on your contributions.

Ready to Give Your Child a Head Start?

NPS Vatsalya is more than just an investment; it’s a profound gift for your child’s future. Imagine them thanking you decades from now for the foresight you had today!

Read more about National Pension System in details.

What are your thoughts on starting retirement planning so early? Share in the comments below!