Do you wonder why some people effortlessly build wealth while others, despite earning well, struggle to manage their expenses? How do they build wealth and what is the difference they are doing? Is that luck? A high salary? Or stock market genies? The answer is No.

In wealth creation, salary, luck, or any other things hardly matter. Then what matters? The real hero in wealth building is TIME. Time is your biggest and greatest asset, yet it is the most underestimated and ignored force in the entire investment journey.

The Real-Life Story That Will Change the Way You Think.

You may find this hard to believe it but still let me share a real-life story. Ronald James Read from Vermont, USA, worked as a petrol pump attendant and night guard. You can imagine how much he may earn from his job. He never ran any business, never earned a high salary. But when he passed away, the world was shocked. He was one of the largest donors in his community, can you believe? He donated more than 6 million dollars (50 Cr in Rupees) to local hospitals and institutions.

What Mr. Ronald did different; he simply invested tiny amounts regularly, stayed invested for decades, avoided debt, and gave his money time to grow. Mr. Read life perfectly explains the power of compounding and the result of staying invested for a longer period.

What is the “Compound Interest“?

The “compound interest” is remarkably interesting, and extremely powerful. You will be going to understand why we are discussing it? And why does the world consider it “Eighth Wonder of The World”.

Let’s understand how it works. In the Compounding process, you are earning money not only on your original investment (principle) but also on returns generated on that investment. You need to keep your money for longer periods to experience compound effects because time accelerates this cycle.

To learn more about the Earning on Earnings, let me share two more stories with you. I am sure after going through the stories, you will understand the magic of compounding deeply.

Mr. Smart’s Investment Story.

Mr. Smart knew about the compounding of interest and the power of time. So, he started investing ₹12,000/- yearly at the age of 24 and decided to continue until the age of 60. He has been investing money for 36 years. We will consider a 10% growth rate (Mutual Fund average annualised returns is 11% to 15% over the last 10 years).

The following calculation will help you to understand how does compounding cycle works.

- First Year:

- First investment + Interest (10% Growth).

- ₹12,000 + ₹1200 = ₹13,200

- Second Year:

- Third Investment + Previous Total + Interest (10% Growth)

- ₹12,000 + ₹13,200 + ₹2520 = ₹27,720

- Third Year:

- Third Investment + Previous Total + Interest (10% Growth)

- ₹12,000 + ₹27,720 + ₹3,972 = ₹43,692

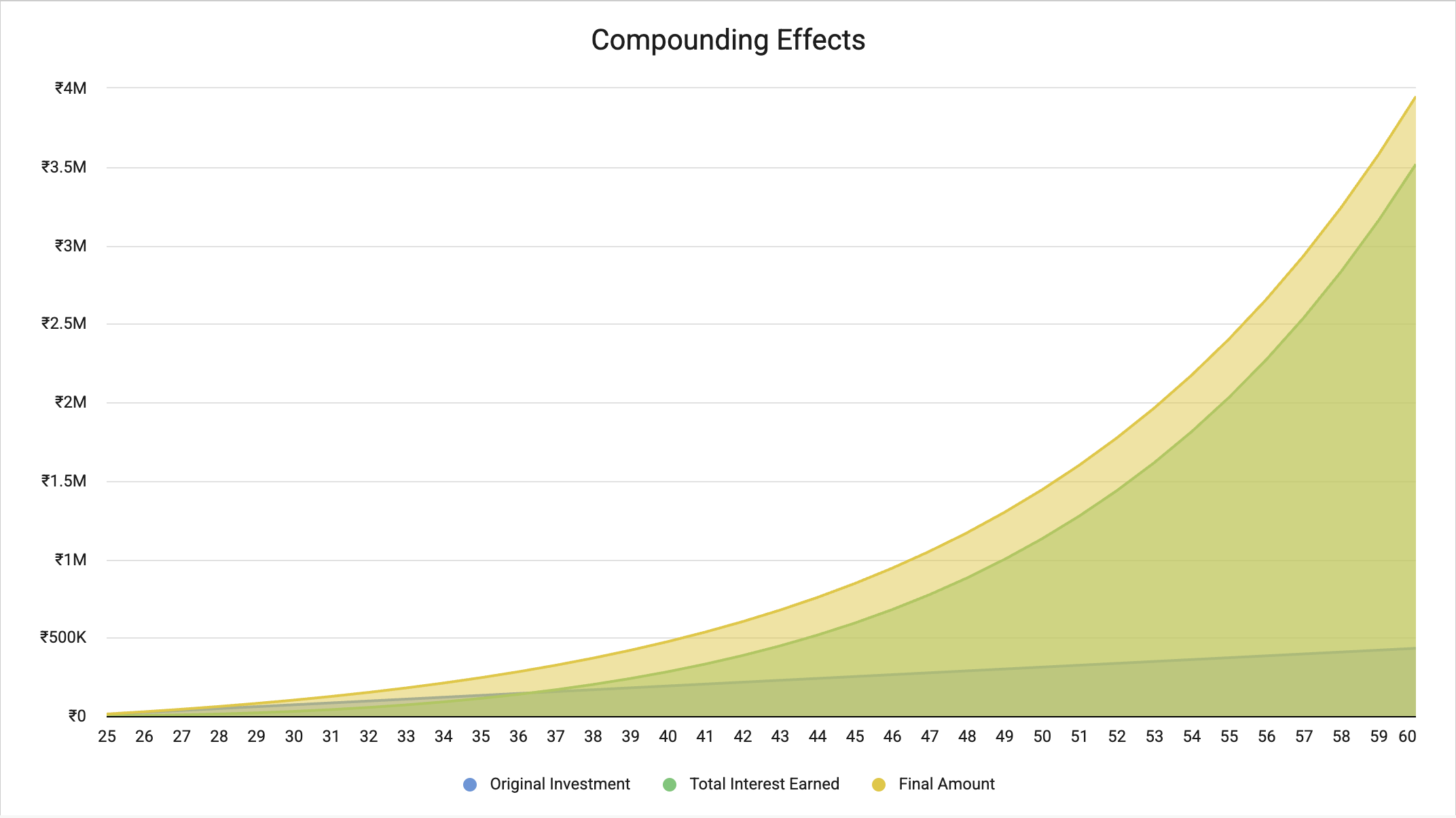

Now we will check the actual growth of Mr. Smart. How much money he invested and how much money he will get at the age of 60. The growth graph and figure will surprise you.

- Investment Duration: 36 Years.

- Yearly Investment Amount : ₹12,000/-

- Annual Return: 10%

- Original Invested Amount: ₹4,32,000/-

- Total Interest: ₹35,16,473.83/-

- Total Value of Your Investment: ₹39,48,473.83/-

Take a close look to above calculation and graph, In the beginning, it barely moves and anyone may think “Is it even growing?” But what happens next? As time passes, growth not just raises… but it takes off. This is the magic of compounding.

Mr. Over-Smart’s Investment Story.

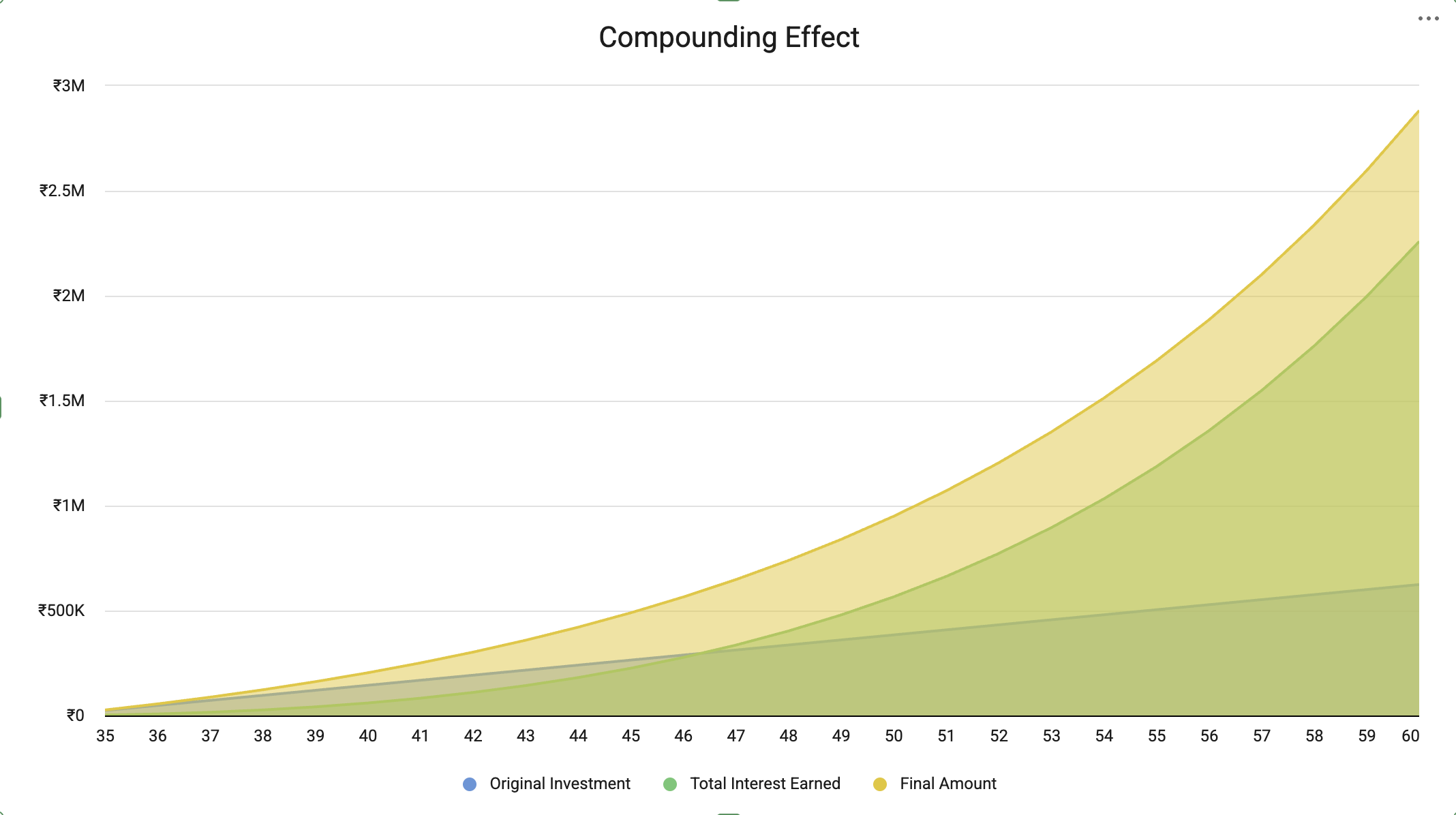

Mr. Smart started 12,000/- yearly investments at the age of 24. But “Mr. Over-Smart” did not take investment seriously and decided to earn more first, then he would think about investment later. He waited for 10 years and started at the age of 34. Realising he already lost a crucial initial 10 years, to match “Mr. Smart” and to cover up the losses, Mr. Over-Smart decided to invest double the amount: 24,000/- yearly.

What do you think, ask yourself honestly, will Mr. Over-Smart’s decision really work? Can delaying investment ever match the power of starting early? Can investing double the money compensate for starting 10 years late? The answer becomes clear when we look at the results.

Calculation is as follow.

- Investment Duration: 26 Years.

- Yearly Investment Amount : ₹24,000/-

- Annual Return: 10%

- Original Invested Amount: ₹6,24,000.00/-

- Total Interest: ₹22,58,398.61/-

- Total Value of Your Investment: ₹28,82,398.61/-

At first, his investment graph may look like Mr. Smart’s, giving a false sense of comfort. The gap between the two tells a powerful story “Time cannot be replaced”. Those lost years silently reduced the power of compounding. This is a reminder for all of us. “Success in investing does not come from being over-smart or waiting for the perfect moment, but from starting early, staying consistent, and letting time do the heavy lifting”.

| Feature | Mr. Smart (Started at 24) | Mr. Over-Smart (Started at 34) |

|---|---|---|

| Annual Investment | ₹12,000 | ₹24,000 |

| Total Years Invested | 36 | 26 |

| Total Money Invested | ₹4,32,000 | ₹6,24,000 |

| Final Portfolio Value | ₹39,48,473 | ₹28,82,398 |

| Net Result | Winner (+ ₹10.6 Lakhs) | Loser (- ₹10.6 Lakhs) |

The moral of the story is.

What do these two stories teach us? Mr. Over-Smart made a critical mistake; he started investing 10 years later. Even though he invested ₹1,92,000 more than Mr. Smart, he still earned ₹10,66,075 less. This clearly shows that in investing; money alone cannot compensate for lost time. Mr. Over-Smart tried to make up for the missed years by investing more, but he could not recreate the compounding magic that happens only when investments are given enough time.

Mr. Smart understood this early and allowed small, consistent investments to grow patiently. These two examples remind us that results do not come from short periods; they come from consistency and time. Compounding rewards patience, testing your belief and discipline in the early years, and delivering extraordinary results in the later years.

(Note: To match Mr. Smart’s performance, Mr. Over-Smart would have needed to invest over ₹32,000 yearly—nearly triple the original amount—just to make up for those lost 10 years!)

Catching Up Is Not the Same as Winning.

Many people think, “I am Young, I will enjoy my money now or I am not earning much, so will invest more later.” It looks good, but it is a trap. Here is why trying to “Catch Up” later is losing battle.

You should work for your money, or should your money work for you?

When you start early and stay invested, Time becomes your most loyal employee, working for you 24/7. In this scenario, much of your wealth comes from “Growth”. Your money and time will work even while you are sleeping.

When you start late, You have to be a worker. You are forced to pump huge amounts of your own hard-earned money just reach to same goal. Now you must choose path to wealth, who do you want working for your money, You or Time?

It puts a “burden” on your life.

Starting early is painless and it brings many benefits like starting investment with small amounts. But trying to “catch up” is painful. To achieve the same result, you must sacrifice a huge part of your monthly income. This means less money for your children’s education, less for family holidays, and more stress on your monthly budget.

There is “No Room for Mistake”

Life is full of surprises like losing jobs, medical emergencies, loans, etc. If any emergency forces you to pause investment for a year, then the early starter decision will provide “safety cushion” and your past money keeps growing.

If you are starting late, then you are not lucky because you are in a race against time, and there is no room to pause your investment.

If you do not have an emergency fund or do not know about it then you can read here and understand the importance of the Emergency Fund. Still

Stress Vs Peace

Wealth is not just about the number in your bank account; it is about how you sleep at night. The person who starts early is calm because he knows time is on his side. The person who starts late is always stressed, checking market conditions, and pressure to manage his budget. There is a massive difference between watching small seeds grow into forests over decades and desperately trying to plant a forest in a few years.

So, remember, the greatest investment decision is not how much you invest, but how early you start. If you haven’t started yet, the second-best time is today.

Time is Real Asset

Book Reference: The Snowball: Warren Buffett and the Business of Life – Alice Schroeder