Table of Contents

- Reduce the Investment Cost.

- Compounding effect, Money grows with time.

- Achieve Financial Goals early and Enjoy Your dreams.

- Financial Discipline, Knowledge and Habits.

- Secure life

- Benefits To Start Investing Early.

To understand the benefits of starting investment early in life or why it is important to start investing early days? just speak to any middle-aged or old age people about their investment journey. They all will say one sentence commonly. Life could be different if they had started investing in the early days. Everyone bears that regret. Do you remember, When you understood the power of money? Maybe during the young days. When you need money but you don’t have it. To complete your needs you may have earned through part-time jobs or saved from pocket money as much as you can.

Many people never start investing with their first paycheck. 80% of people get tempted to spend their money on unwanted things. Some convince themselves they can not start investing in such a low salary. Someone’s ignorant mindset tells them they just started earning, so they will decide later about the investment. The list of excuses is too long to postpone investment. We always choose one reason to push the investment last on the list. So if you got your first job and just started earning, you must decide about investing and financial freedom. This article will help you with it.

We are here discussing money then you must know about money management. Why it is necessary to do your financial planning first. It is an important step before starting to invest and manage your money. If you do not do it then, you will spend more than your earning. You would struggle to save money or complete your needs and this way sooner or later you will lose your wealth. Let’s understand all the points and benefits of early investment. Before starting, we would like to suggest you please read about the Benefits and how to do financial planning.

Reduce the Investment Cost.

Are you starting to invest in your early days? Congratulations, now you can reduce your investment cost. Most of us have fewer responsibilities at an early age and must use this advantage effectively. It will give you the freedom to take risks and the time to manage them properly. You invested in some risky assets for high returns and you failed. Even after a loss, you will have enough time to recover it. Such an experiment will be a valuable lesson for you which will help you to plan your next investment cautiously. We will see later what are risky investments but we all know they give good returns.

The biggest benefit of starting early reduces your investment amount. Let’s take an example of how it helps you can start with a small amount. Raju and Sanju are good friends and both are in their 21. Both wished to have a luxury car at age 31. They calculated and estimated they may require 70 lakhs to buy the car after 10 years. To understand this, Le’s do some calculations and will keep it simple to understand. Both decide, every month they will invest some amount in investment assets with an expected return of 12% p.a which is average.

Raju knew the benefits of an early start. He started investing 31,000 per month at the age of 21 to reach his car goal. On that basis, let’s check the calculations. His total investment will be 37,20,000 INR, and his estimated interest (12% p.a.) on investment will be 34,82,511 INR. So after 10 years, at the age of 31, he will get 72,02,5111 INR.

But Sanju ignored all the benefits and started investing 2 years later. So to reach his goal, he has to invest 45,000 INR every month. His total investment will be 43,20,000 INR, and his estimated interest (12% p.a.) will be 29,48,695 INR, after 8 years he will get 72,68,695 INR.

So if you check the above figures, Sanju’s monthly amount increased by 14,000 INR. He spent an additional 6,00,000 from his pocket and received 5,33,816 INR of interest less compared to Raju’s interest amount. Sanju paid more just because he wasted two years. Early start reduced Raju’s cost of investment and also earned more interest compared to Sanju. Now you decide is it better to invest early or invest late?

Compounding effect, Money grows with time.

Big things never build in a single night. Wealth also takes time to grow its own value. It is only possible when you start investing early in your life and give time to yourself and your money to grow. The compounding effect in investment shows magical performance if you stay invested for a longer period. Let’s see how.

First, understand the compounding effect of investing because it motivates many people and helps build investment strategies. Compounding is a process in which you reinvest your earnings ( capital gain or interest ) to generate additional earnings from it over the period. In simple words, in the Compounding process, you are earning interest on your principal amount as well as on interest that you earned to date. Let’s check the following calculation, I am sure that will help you to understand it more effectively.

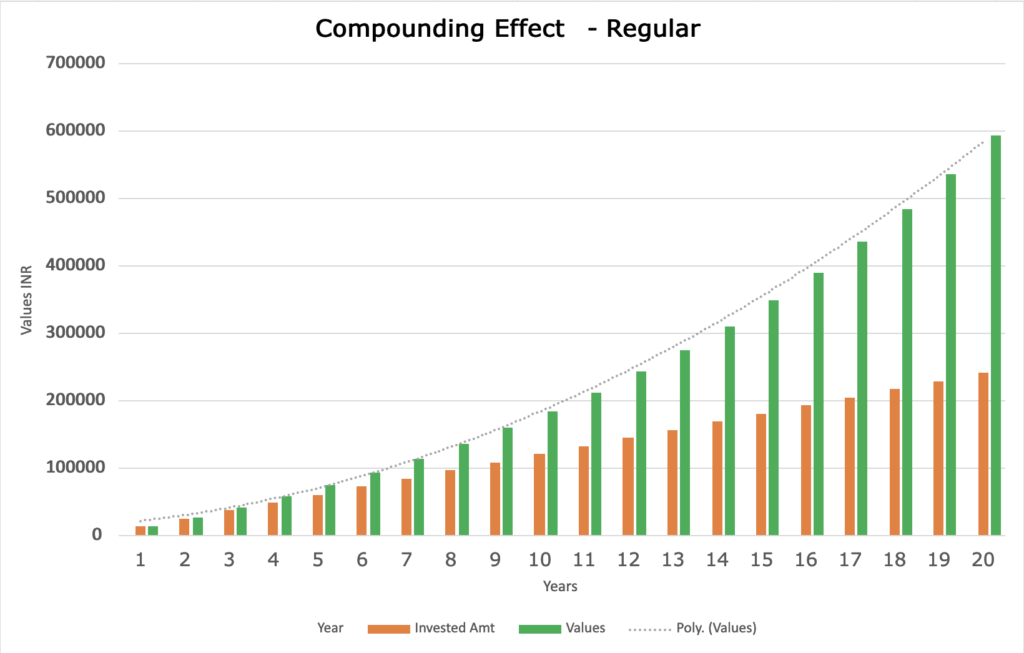

Compounding Effect Sample 1: Investing 1000 ₹ per Month for 20 Years.

To Understand the Compounding effect let’s take an example. Mr Shamrao has invested 1000 Rs monthly for 20 years and received an average of 8% annual interest. Earned Interest will be added to the initial principal. So in the first month, he deposited 1000 and earned 6.67 Rs interest on it. According to the compounding process, interest will be added to the principal amount and now it has become 1006.67. Next interest will be calculated on it. This will work like it for the next 20 years.

| Years | Total Invested Amount | Total Amount | Growth % |

| 1 | 12,000 | 12,532.93 | 4.44% |

| 5 | 60,000 | 73,966.7 | 23.28% |

| 10 | 1,20,000 | 1,84,165.68 | 53.47% |

| 15 | 1,80,000 | 3,48,345.14 | 93.53% |

| 20 | 2,40,000 | 5,92,947.22 | 147.06% |

Disclaimer: Please note that these calculators are for illustrations only and do not represent actual returns.

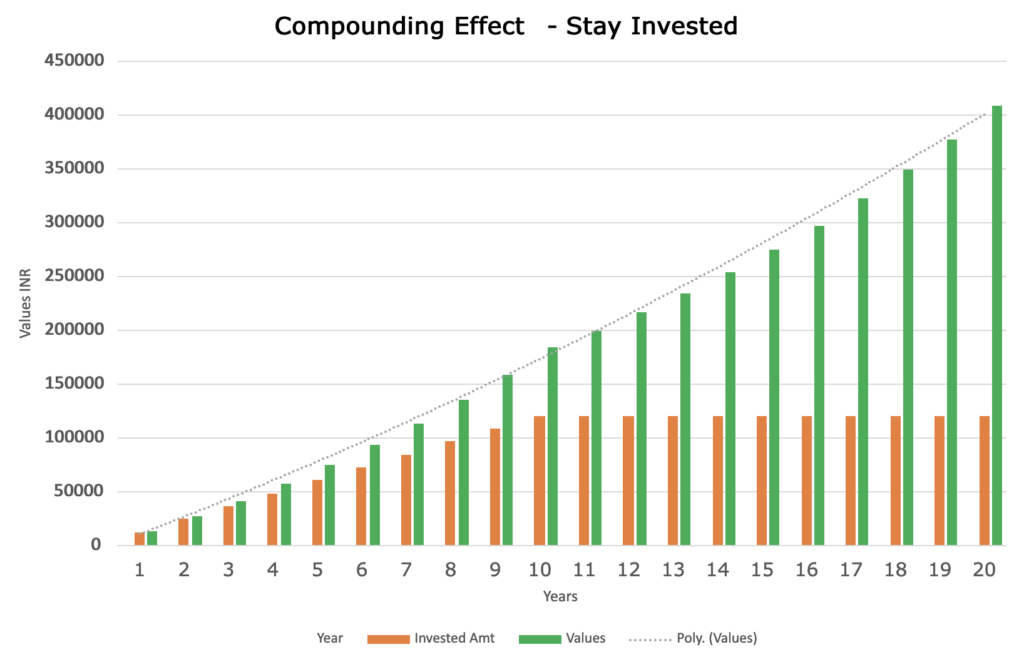

Compounding Effect Sample 2: Investing 1000 ₹ per Month for 10 Years, Stay Invested for 20 Years.

| Years | Total Invested Amount | Total Amount | Growth % |

| 1 | 12,000 | 12,532.93 | 4.44% |

| 5 | 60,000 | 73,966.7 | 23.28% |

| 10 | 1,20,000 | 1,84,165.68 | 53.47% |

| 15 | 1,20,000 | 2,74,378.44 | 128.65% |

| 20 | 1,20,000 | 4,08,781.54 | 240.65% |

Disclaimer: Please note that these calculators are for illustrations only and do not represent actual returns.

So what you require to enjoy the compounding effect, you must strictly follow 3 rules. Rule No. 1. Start Early. Rule No 2. Never stop your investment and be regular. Rule No 3. Over time increase the investment amount.

Achieve Financial Goals early and Enjoy Your dreams.

People wish to travel around the world after retirement, build a retirement home, and have medical security. But many of them struggle with their bills, debt and financial responsibilities, and that forces them to work for longer periods. Trust me, without financial freedom, you will not retire on time and never complete your wish. Financial freedom comes with time and time is limited so have to use your time wisely.

Retirement is one of the primary goals of many people. But bad money management or a delay in investing can force you to work even after retirement. Start at the right time to retire early and peacefully, so you can enjoy more time with your dreams. It also helps you to achieve your financial goals on time. Everyone has life dreams, and to live those dreams, wise people always start investing at the right time and manage their goals to achieve them.

Financial Discipline, Knowledge and Habits.

When you start investing, you create your financial plan. You track your earnings and spending very closely. You understand your financial condition better, which provides stability to your financial journey. Over time, you learn to manage your money in a better way.

“Save first, Spend later” rules bring discipline and motivate you to make provisions for investments before you start paying your bills. So you will not have unnecessary items on your spending list. You can also try different types of investment assets and combinations that help you acquire knowledge. Such practices help you to achieve a balance between risky and secure investments, and they also reduce your “Financial loss” possibilities.

Your regular activities create financial habits. Habits like analyzing and monitoring your investment help to make better strategies. As an investor, you train yourself to be disciplined and acquire more knowledge on different types of assets, managing Tax and investing ideas. If you want to achieve something, you must be Disciplined, Knowledgeable and have Good Habits. Equally, in the financial world, you require this. Starting early in investing buys more time for you. Time is essential for building habits, gaining knowledge and bringing discipline.

Secure life

As a part of Financial Planning, we created an emergency fund to handle unpredictable financial crises. But there are some problems which we can not solve with such funds. Every situation has different solutions. We all experience a hectic lifestyle like stress, workload, relationship or emotional issues and its side effects.

According to some reports around 29% of people die because of cardiovascular diseases. On the other side, some other reports said the cost per hospitalization increased by 104%. We can understand now how medical bills can wash out our savings. So we need health insurance to protect our investments and to deal with such situations.

If you buy your insurance at a young age, you will pay low premiums because insurance premiums increase with age. Immediately you will also get protection for your health because there will be fewer possibilities of any pre-existing diseases. Once you get the insurance and any health issue is detected later will automatically get covered with no extra cost. Along with health protection, you can avail of other services like pre and pro-hospitalization expenses, daycare, OPD, yearly medical checkups, and ambulance services.

You will pay more according to your age if you do not get insurance early in life. The possibility of health issues increases with age and if any diseases are detected then the insurance company can impose a waiting period and also an additional cost for the same and you will lose the benefits from it.

Health insurance also helps to save tax means the amount which you paid for health insurance can be deducted from taxable income. You can claim under Section 80D of the Income Tax Act, 1961. So health or medical insurance helps you to manage your taxes also.

Benefits To Start Investing Early.

Finally, I hope the purpose of this blog is achieved so all my readers may understand the “importance of investing early”. Starting early investment gives you a peaceful and financially stable life. You would become capable and have enough time to handle financial crises or recover your losses. Because of buying insurance at an early age, you will spend less on insurance. It will take care of your medical expenses and enjoy other benefits at an early age. You can start investing with a comfortable amount. An early start will reduce investment costs. Not to worry about how much you are investing because combinations of compounding effects and long periods will generate huge returns.

An early start will help you retire early and give you a secure, peaceful and relaxed retirement life. After reading, you will get the answer to “Why is investing a more powerful tool to build long-term wealth than saving?” You can start investing in Mutual Funds and Share Markets. Mutual Fund investing is considered a safe way of Investment. Learn more about Mutual Funds. Create your financial plan or you can take the help of a Financial Planner to start an investment journey.