Table of Contents

- Why do you need to learn Money Management?

- What is Financial Planning?

- Build Emergency Fund.

- Start Budgeting.

- Set Financial Goals

- Investment plan

- Conclusion

Our education system is designed to prepare generations to earn money and not to teach Money management or financial planning. You may meet some people who are not very serious about their Financial Plan or don’t know about it. It is because they may not understand the financial risk or ignorance behaviour. Even the younger generation never thinks about it and starts Financial Planning and investment very late.

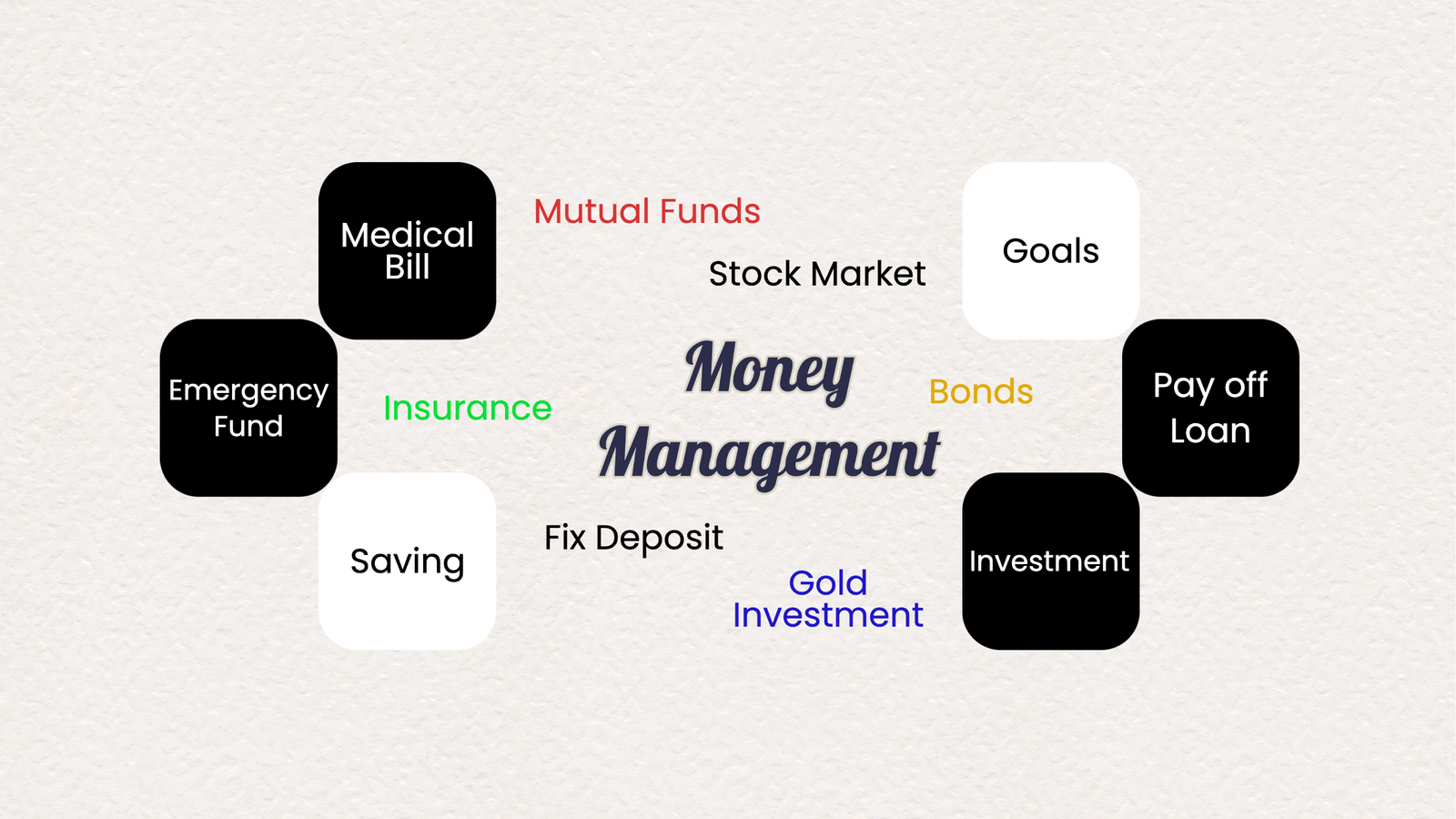

Why do you need to learn Money Management?

Inflation always reduces your purchasing power. Let’s have an example to understand, we all have a bank account and keep our money in it as savings. Let’s assume you want to purchase XYZ item and today’s prize is 1000 rs. But you’re planning to buy it next year. So you saved 1000 rs in your bank account.

India’s average inflation for the last 10 years is 6.14. Now let’s do the calculation. After one year because of inflation, you have to pay 1061 rs for the same item which was 1000 Rs last year. Otherside you kept your money in a bank account and the bank gave 4% interest on your 1000 which made 1040. A bank savings account gives roughly 3.5% to 4% interest on your savings.

So if you understand, inflation reduces your money value by 21 Rs in purchasing power. Now you can imagine how important to understand inflation, Saving, Investment, and Financial Planning. We all have dreams about our own homes, education, and new cars. We can not live and enjoy our dreams if we do not beat inflation.

If you want to learn how to beat inflation then you are at the right place.

What is Financial Planning?

After talking with people about their financial issues, I realized most of them think they are in financial problems because they are earning less or have loans or Medical bills. But the real cause behind financial issues is the lack of financial knowledge, spending before saving, knowingly and unknowingly spending more than your income etc.

So let’s understand why personal Financial Planning is important with a real-life example. I got to know about the story from the book “The Psychology of Money” by Morgan Housel. The life story of two people. Let’s meet our characters with little details about them. The name of the first character in the story is “Mr Ronal Read” who works as a gas station attendant, caretaker and machinic. He lives his life with hard work and a simple lifestyle. He owns a 2 bedroom house and spent his entire life there. He was the first High School graduate in his family. He struggled a lot in his childhood days.

Mr Richard M. Fuscone, the second character of our story, was opposite to our first character “Mr Ronal Read”. Richard was well educated. MBA from the University of Chicago also attended Harvard Business School. He was one of the top Wall Street executives and Merrill Lynch’s one-time head of Latin America. He owns an 18,000-square-foot house and spends 80,000 dollars every month to maintain it.

Both were in the news but with different headlines. Mr Ronal Read for charity, donated 6 million dollars to the local hospital and library. On the other side, Mr Richard Fuscone declared personal bankruptcy and sold his 18,000 sq. ft. house in foreclosure auctions. If you noticed both were opposite to each other, in their educations, jobs, pay and lifestyle but Mr Ronal Read became a philanthropist and Mr Richard Fuscone told the bankruptcy judge that “He does not have money.”

What does this story tell us? Good jobs, big pay and education are meaningless if you do not know how to manage your money and investment. Education or any skill may help you to earn money, but that is not enough to stay wealthy. You will get many examples of people who earn good money but fail to stay wealthy. Let’s discuss how we can create wealth. I am sure after going through this blog you will understand better finances.

Build Emergency Fund.

The emergency fund is the most important part of our journey. So what is an emergency fund and why is it so important? Emergency funds are the protectors that will protect you from unplanned expenses like car or home repairs or unavoidable emergencies like lost income or jobs, medical bills, etc. We all have somewhere experienced unexpected financial crises in our lives. Such crises are capable to push us into a debt trap or destroy our long-term investment and future goals.

Read more about Emergency Fund.

Start Budgeting.

Budgeting is the 2nd most important step. Many people think budgeting is a complex, scary or boring process. But they do not know that it is a powerful tool that helps us to manage our every rupee. We can make sure how our money will be used. It will record where we spend our hard-earned money. When you start budgeting, you may be surprised to see how much money we earned, saved, invested and spent on such things which were not even on our priority list. That money could be used to build an emergency fund or to reduce debt.

Budgeting will help us prioritize our requirements. We can arrange funds which we require every month like mobile or electricity bills, Home Rent or maintenance and yearly funds like health or life insurance premiums, taxes, education etc. It will make our life relaxed as budgeting helps us to understand our financial condition and how we doing for them. Budgeting will bring financial discipline to life. We will enjoy progress towards our financial goals.

Set Financial Goals

Financial goals are like milestones, when you reach them, you will feel like an achiever and bring you closer to your future. Financial goals will also motivate you in your budgeting because both support each other. Let’s understand Financial goals. Financial goals must be achievable, realistic and aligned with your source of income and investment. So before we set our goals, let’s understand three major categories.

- Long Term

- Mid Term

- Short Term

Short Term: The goals in this category can be achieved within a year. We can plan new Apple Watch, television, Game console or small vacations or Dinner – Lunch, small academic courses etc. It is less important, even if you fail, life won’t change in bad. So be ready to sacrifice some goals ( always try to achieve what you decide.) for Long Term or Mid Term Goals.

Mid-Term Goals: We can give more than a year and less than 3 years to achieve goals in this category. Goals in this category are a real challenge and very important. It may affect your budget or long-term goals. It can be a partial part of your long-term goals. So give more focus, discipline and better budgeting for this category. Paying off debts, an Emergency fund for one year ( later we must extend up to 2 years ) and down payments for car, big vacations etc.

Long-Term Goals: We can assign more than 5 years for Long Term Goals. So comparably we have more time to adjust or re-align our financing or budgeting.

Investment plan

An investment plan is different from a Financial plan. A financial plan is a process to set direction to achieve goals and to deal with financial surprises. An Investment Plan is like a driver for a financial vehicle, which drives money to financial goals. We need to put our money to work to generate income and reduce financial risk. As we all know without multiple sources of income, we can not become financially independent. We will invest our money in such asset classes which give better returns. So make your money work for you.

Let’s take an example to understand what an asset class and investment plan are. Suppose we saved some money and are planning to invest it. So we will make a plan to decide how and what percentage will be allocated to the various investment classes ( Asset Class ) like Cash, Share Market, Mutual Funds, Real Estate, Bonds or various types of gold investment. Before investing, we need to consider our goals, risk-taking capacity and asset knowledge.

Every asset performs differently so its risk and return will perform accordingly. Keeping money in a savings account is more secure than investing in the share market. Saving But the performance of both assets is different. Bank accounts give fewer returns but shares can generate extra income like dividends or/and good appreciation in the long term.

Conclusion

Everyone must learn wealth management along with their academic education. It is very important when you plan your future life and dreams. It will protect your money, time and peace of mind. You are not required to have any special skill to become an investor or financial planner just follow some basic rules as below.

- Start your investment early and regularly.

- Create and monitor your budget and investment plans.

- Always keep learning about investment and asset class performance.

- Never invest all your money in a single asset.

- Re-evaluate investment at least once a month based on time, requirement, and asset performance.

- Stay invested for the long term.

- You can take help from Financial Planning Services or Investing services which can help you in your journey.